Everything you missed from the Startup Battlefield Latin America

The tech scene in São Paulo is an absolute delight, and we’re honored to have seen such an amazing turnout at the Startup Battlefield Latin America.

In case you missed it, we’ve put together a little recap of the event below.

Editor’s Note: We will embed videos from the event as soon as they’re available.

A China Twist to Brazil’s Mobility Revolution

Featuring Ariel Lambrecht (Yellow), Eduardo Musa (Yellow), Tony Qiu (Didi Chuxing), Hans Tung (GGV)

Mobility is a massive challenge for megacities around the world, including Sao Paulo. The first panel of the event featured notable founders and investors attempting to solve this problem in Brazil and throughout Latin America.

Eduardo Musa is the cofounder and CEO of Yellow and was joined on stage by his cofounder Ariel Lambrecht. Lambrecht also founded the mobility company 99, which is the only startup worth more than 1 billion USD in Brazil. Didi Chuxing recently invested and purchased 99, and current CEO and former investor Tony Qiu sat on the panel as well. Lastly, Hans Tung, managing partner at the Silicon Valley firm GGV and lead investor on 99’s latest round, joined the group. The panel was moderated by TechCrunch’s Managing Editor, Matt Burns.

Both Musa and Qiu acknowledged the crisis facing the Brazilian market and noted parallels with the Chinese market. Both markets have megacities with a diverse population, and there are countless opportunities for startups to address.

Throughout the panel, it was noted that Brazilian startups face several obstacles including finding enough talent and investment. The panelists agreed that often companies in Brazil are looking to Silicon Valley for both. For hiring, they said, there are not enough engineers locally, and to obtain funding, it’s best to show growth to local investors and the look tow Silicon Valley for additional investors.

Fireside Chat

Featuring Cristina Junquiera (Nubank) and David Velez (Nubank)

Any kind of partnership with a global internet giant is a big win for a startup. Nubank co-founders David Velez and Cristina Junquiera took the stage at Startup Battlefield Latin America to discuss Tencent’s $180M investment into their Sao Paulo-based digital banking company. Nubank is has raised over $700M from hard hitting investors like DST and Sequoia, valuing the company at over $4B, so it’s not about the money. While the invest to buy strategy is common for Chinese internet giants, Velez says that isn’t the goal for Nubank.

The founders are focused on the 20 million customers who have already applied for their credit card, and building culture from the ground up. There’s a lot wrong with Brazilian banks, and Nubank is taking a customer-focused approach to provide its digital banking service for Brazil’s huge population. When you’re one of the most successful companies in a region, you feel a responsibility to give back to the ecosystem. The best way to do that, say Velez and Junquiera, is to set an example of success.

Venture Investing In Latin America Today

Featuring Eric Acher (Monashees), Veronica Allende Serra (Innova Capital Consultoria Ltda), Hernan Kazah (Kaszek), Fernando Lelo de Larrea (ALLVP)

Latin American startup companies have hit an inflection point. No longer an afterthought for global investment firms the region is on pace to surpass $1 billion in committed capital for the second year in a row.

Driving that growth, according to investors Eric Acher, the co-founder of Monashees; Veronica Allende Serra, the founder of Innova Capital; Hernan Kazah of Kaszek Ventures and Fernando Lelo de Larrea of ALL VP; is a rash of exits like the public offering for the payment technology provider Stone and the sale of ride-hailing company, 99, to the Chinese global giant mobility company, DiDi.

Yet, as the market grows, entrepreneurs need to consider the partners they’re bringing on board as the aim for international growth. And while Brazil leads the pack in terms of committed capital — grabbing 73% of the total money invested in the region in the first half of the year — Argentina, Colombia, Mexico, Peru and Chile are all emerging as important capital markets in their own right.

20 Years Ahead of the Curve

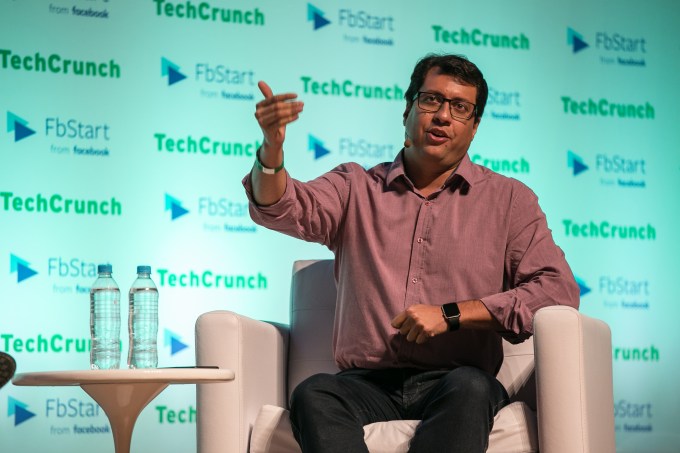

Featuring Fabricio Bloisi (Movile)

For Fabricio Bloisi, the journey to building a multi-billion dollar company in Movile wasn’t always easy. Building a business requires making tough decisions along the way and a commitment to constantly churning through ideas.

Over the first ten years of its existence, Movile struggled as a smaller content provider. It was once the company agreed to consolidate and control more of the market that it began to grow, Bloisi said.

Now, businesses like iFood, which brought in over $100 million in revenue in the month of October alone, and new payment businesses like Zoop and its delivery and logistics companies, are contributing to a powerhouse that Bloisi thinks could be a $10 billion company in a few years.

Bloisi believes in the region, and the promise it holds for local and international investors to build more multi-billion dollar businesses. The future belongs to the entrepreneurs in the audience, Bloisi said. And if they can make the tough decisions (and get the right investment partners) they could find themselves on the TechCrunch stage.

New Wave Latin Founders

Ana Lu McLaren (Enjoie), David Arana (Konfio), Sebastian Mejia (Rappi), Juan Pablo Bruzzo

A vast majority of startup and investment activity across Latin America is coming out of Brazil. But that doesn’t mean entrepreneurship doesn’t thrive in other parts of the region. Rappi co-founder Sebastian Mejia, Konfio’s David Arana, Moni’s Juan Pablo Bruzzo and Ana McLaren from Enjoie discussed the challenges of launching and scaling an early stage tech company in this new wave founder discussion. Volatile economies, scarce technical talent, and undercapitalized markets aren’t so much challenges, but opportunities for these founders.

Logistics, fintech and ecommerce sectors are getting shaken up by these founders, and the foreign investment dollars are following. Rappi just raised a $200M round to grow its last-mile delivery service, but threats from foreign powerhouses like Uber threaten to eclipse market share. The landscape is more competitive than ever for founders, so expect to see big moves happening from startups launching out of the region.

from News Aggregator - Top News Stories From Your Favourite News Source | News Vally https://ift.tt/2QDo4rO

No comments

Post a Comment