One possible solution to cellular agriculture’s biggest problem — how to develop a cheap, humane, growth material for cultured meat — may have come from a conversation in line at a Tim Hortons in Alberta.

The husband and wife duo of Matt and Jalene Anderson-Baron were waiting for Timbits and coffee and talking about the technology behind their startup, Future Fields, when Jalene suggested a possible new growth medium.

Matt Anderson-Baron had hit a wall in his research, and the pair, which represented two-thirds of the founding triumvirate of Future Fields, were out for a snack. Along with co-founder Lejjy Gafour, the three friends had set out to launch a startup from Canada that could do something about the world’s reliance on animals for protein.

They recognized that the attendant problems associated with animal farming were unsustainable at a scale needed to meet global demand for meat. So the three turned their attention to cell-based alternatives to the meat market.

“It was all just our interesting crazy side project that we never thought would turn into a business,” said Jalene Anderson-Baron. “That has evolved into a successful business idea over the last year.”

Future Fields co-founders. Image credit: Future Fields

Initially, the trio had hoped to launch their own cultured meat brand to sell lab grown chicken to the world, but after four months spent experimenting in the lab, Matt Anderson-Baron and the rest of the team, decided to pivot and begin work on a new growth serum. All thanks to Tim Hortons.

“Our MVP was a chicken nugget. It worked out to be about $3,000 per pound… Which is obviously not a lucrative business model. Given that the aims was to produce something price comparable to meat,” said Anderon-Brown. “We shifted to focus on a new medium that would be economically viable. Originally we intended it for something that just we used. We didn’t realize at first the novelty of our product and how beneficial it would be to the industry. About eight months ago we decided to pivot and make that growth medium our product.”

Now, as it gets ready to leave the Y Combinator accelerator program, the company has some paid contracts in place and will be rolling out the first couple of pilot product lines of its cell growth material for shipment within the next month.

The potential demand for the company’s product is huge. Alpha Meats, Shiok Meat, Finless Foods, Memphis Meats, Meatable, Mosa Meat, Aleph Farms, Future Meat Technologies, Lab Farm Foods, and Eaat, are all companies developing lab grown alternatives to meat and fish. All told, these companies have raised well over $200 million. Some of the biggest names in traditional meat production like Tyson Foods are investing in meat alternatives.

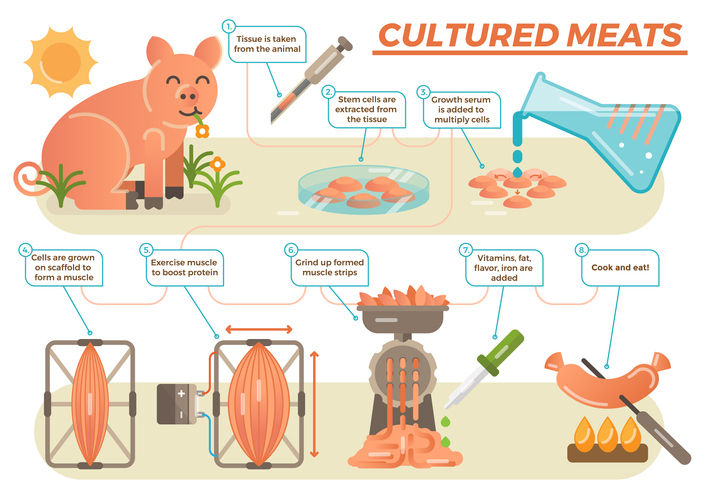

Image Credit: Getty Images/VectorMine

“It’s about getting the price at scale. The companies that are using smaller volumes are bringing it down 10 to 100 times cheaper. We can do that. But our superpower is producing the growth medium at scale and doing it 1,000 times cheaper,” said Matt Anderson-Brown. “We’re talking about $2 to $3 per liter at scale.”

Future Fields’ founders didn’t say much about the technology that they’re using, except to say that they’re genetically modifying a specific organism by inserting the genetic code for specific protein production into their unidentified cell line to produce different growth factors.

The University of Alberta isn’t unique in its development of a Health Accelerator Program, but its equity-free approach allows startups and would-be bio-engineering entrepreneurs an opportunity to develop their businesses without fear of dilution.

Future Fields has already raised a small, pre-seed round of $480,000 from a group of undisclosed angel investors and the Grow Agrifood Tech Accelerator out of Singapore.

And company has the capacity to produce a few hundred liters of its growth factor, according to Gafour, and is working on plans to scale up production to hit tens of thousands of liters per month over the next year.

For Gafour and his compatriots, the cellular agriculture industry has already reached an inflection point, and the next steps are less about scientific discovery and radical innovation and more about iteration and commercialization.

“With the inclusion of a growth media solution, the core pieces are in place, and now it’s a matter of understanding the efficiencies in being able to scale it up,” said Gafour.

Still, there are other components that need to be developed for the industry to truly bring down costs to a point where it can compete with traditional meat. Companies still need to develop a scaffolding to support the growth of protein cells into the muscle and fatty tissues that give meat its flavor. Bioreactor design needs to improve as well, according to Matt Anderson-Baron. “It’s the wild west. There’s so many things still to be done.”

And there are many companies working on these technologies as well. Glycosan, Lyopor and Prellis are all working on building tissue scaffolding that can be used for animal organ development.

“The vision oif our company was to accelerate this industry and move the industry along,” said Jalene Anderson-Baron. “At first we didn’t realize the potential of our technology. We thought that everyone would overcome that roadblock around the same time. As we were speaking with other companies and speaking with investors who had been in touch with other companies, we realized this was the key piece to move the industry forward.”

from TechCrunch https://ift.tt/3fjMHVF